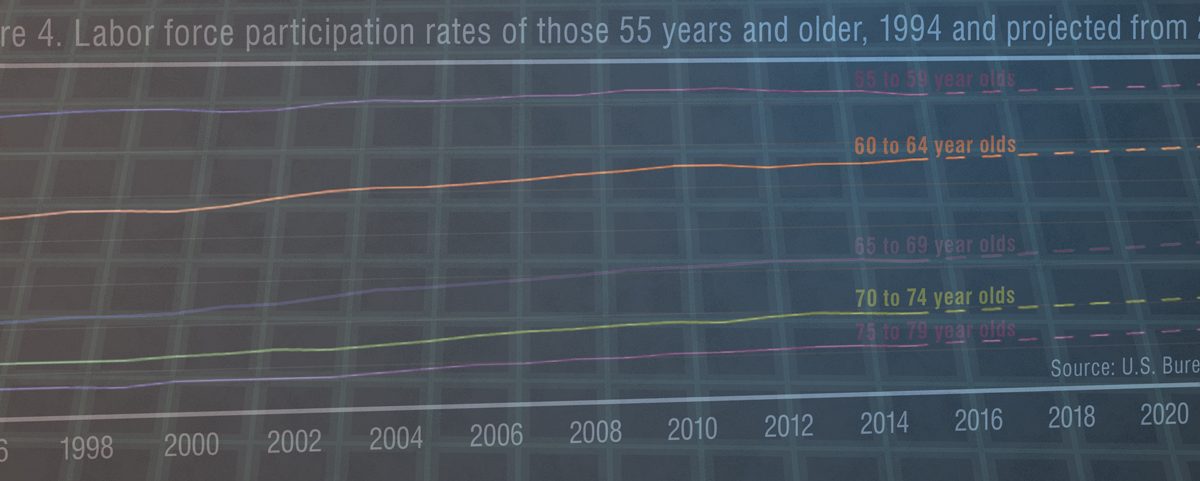

Image adapted from Bureau of Labor Statistics, 2015 [1]

Introductionꜛ

While many older Americans look forward to their retirement years with great anticipation, a substantial subset of the aging population is struggling to prepare for retirement and is deeply concerned about the financial realities of this later stage of life, according to a new study conducted by The Associated Press-NORC Center for Public Affairs Research.

A majority of Americans have multiple retirement income sources, but 53 percent say they feel more anxious than secure about the amount of savings they have for retirement. Only two-thirds of those who are still working are currently saving for retirement, and many are juggling competing financial obligations that make saving a challenge. Many older Americans plan to rely heavily on Social Security to fund their retirements and also plan to take these benefits early, even though doing so may reduce the total amount they receive.

These new findings come at a time when the population is aging rapidly, and reliance on Social Security is already high. By 2040, the population age 65 and older is expected to be 82.3 million, which is more than double its size in 2000.2 Based on 2014 data, the Social Security Administration reported that 61 percent of Americans age 65 and older receive at least half of their income from Social Security, and nearly 20 percent receive all of their income from Social Security.3

To get a comprehensive picture of the work and retirement issues facing older Americans, The AP-NORC Center has conducted two major studies with funding from The Alfred P. Sloan Foundation. The first study, conducted in 2013, explored the modern concept of retirement, which is shifting to later in life for many and also no longer involves a complete departure from the workforce.4 This study also investigated anxieties about retirement planning and the factors older Americans consider when making decisions about the transition to retirement.

This new study, conducted in 2016, extends this work and focuses on both working longer5 and retirement issues. The findings presented in this report focus on attitudes and planning behaviors about retirement. The survey also reveals a number of inequalities in older Americans’ retirement planning, with significant divides between lower- and upper-income Americans. Income levels and feelings of anxiety are also related to the type and number of income sources individuals have or expect to rely on during retirement. The AP-NORC Center, with funding from The Alfred P. Sloan Foundation, conducted 1,075 interviews with a nationally representative sample of Americans age 50 and older.

The key findings from the survey, summarized below, provide further insight into specific anxieties and obstacles that older Americans face as they plan for retirement.

- Four in 10 older Americans feel more anxious than excited about retirement. Those with lower household income levels, who sometimes lack the resources to pay their bills on time and/or carry personal debt, are more likely to say that they feel more anxious than those who are in better shape financially.

- Older Americans with lower incomes are more likely than higher earners to say that they feel more anxious than secure about several specific aspects of retirement, including the size of their retirement savings and their ability to pay for housing and health care expenses in the future. For example, a majority of those with household incomes under $50,000 (58 percent) say they feel more anxious than secure about the amount of savings they have for retirement. But even among those with incomes of $100,000 or more, 40 percent are anxious about the overall savings.

- Two-thirds of working older Americans are currently saving money for retirement. Those with lower incomes are less likely to say that they are saving money for retirement than other older Americans (47 percent for those earning less than $50,000 vs. 90 percent of those earning $100,000 or more).

- Most Americans age 50 and older report that they have multiple sources of income for retirement, but a substantial minority (44 percent) expect that Social Security will provide the biggest portion of that income. Those who have lower incomes are more likely to plan to rely heavily on Social Security (54 percent for those with incomes of less than $50,000, compared with 25 percent for those with incomes of $100,000 or more) and also tend to report fewer sources overall.

- Only a third of older Americans who have retirement accounts or other retirement investments have high levels of confidence in how those investments are being managed. Confidence is low across the board no matter if people are managing their investments themselves, relying on a financial advisor, or having family help to manage their investments.

These results provide insights for policymakers grappling with how to help older Americans prepare for retirement. They also inform the debate around the Social Security program.

Additional information, including the study’s complete topline findings, can be found on The AP-NORC Center’s website at www.apnorc.org.

A Majority Of Americans Say They Are Generally Excited About Retirement But Only A Third Of Older Workers Consider Themselves Financially Prepared.ꜛ

Fifty-three percent of Americans age 50 and older say they are more excited than anxious about their retirement, and 41 percent say they are more anxious than excited. Those who are completely retired are more likely than those who are still in the workforce to say they are excited about retirement (62 percent vs. 47 percent).

In addition, anxiety about retirement is closely tied to personal financial outlook. Those with lower levels of income, those who are struggling to make ends meet, and those who are carrying personal debt are more likely to say they are anxious about retirement.6

Of those Americans age 50 and older who do not yet consider themselves retired, 34 percent say they are very or extremely financially prepared for retirement, 39 percent say they are somewhat financially prepared, and 27 percent say they are not very or not at all financially prepared for retirement.

While those with lower household incomes report being more anxious about retirement in general than those with higher incomes—and the section below reveals that they also feel more anxious about several specific financial aspects of retirement—there do not appear to be substantial differences between these groups in terms of feeling financially prepared for retirement.

Financial Concerns Are More Often Cited As Highly Important In Retirement Decisions Than Any Other Factors.ꜛ

We asked Americans age 50 and older who retired by choice and those not yet retired about the importance of various factors in the decision about when to retire. Among this group, financial needs are cited as extremely or very important more often than any other factors in the decision about when to retire (69 percent). Majorities also say that health reasons (64 percent), job satisfaction (58 percent), their ability to do their job (57 percent), need for employer-sponsored benefits (54 percent), and wanting more free time (51 percent) are highly important factors. Fewer than half (40 percent) say that their spouse or partner’s retirement plans were, or will be, an important determinant of retirement timing.

These factors are related to whether people feel anxious or excited about retirement. Those who say they are more anxious about retirement place higher importance on the following factors for the decision about when to retire than those who say they are more excited: financial needs (83 percent vs. 60 percent), need for employer-sponsored benefits (63 percent vs. 50 percent), personal health (79 percent vs. 54 percent), and ability to do their job (74 percent vs. 47 percent).

When it comes to specific aspects of retirement, about half of Americans age 50 and older say they feel mostly anxious when it comes to the amount of savings they have for retirement (53 percent) and being able to pay for major unexpected medical expenses (50 percent). On the other hand, a majority of Americans age 50 and older say they feel mostly secure when it comes to their ability to keep up with their housing payments (67 percent) and their physical health (57 percent).

For each of these four aspects of retirement, feeling secure or anxious is related to household income and age. For example, 55 percent of Americans age 50 and older with household incomes of less than $50,000 say they feel mostly anxious when it comes to being able to pay for major unexpected medical expenses during retirement, compared with 42 percent of those with household incomes of $100,000 or more. Americans age 65 and older are about twice as likely as those age 50 to 64 to say they feel mostly secure about their retirement savings (61 percent vs. 31 percent).

A sizeable number of Americans age 50 and older have fears about how long their retirement savings will last. About a third say that it is most likely that they will outlive their savings, while 29 percent say their savings will outlive them and 37 percent say their savings will be just about right to cover their needs throughout retirement. Those who feel more anxious about retirement are more likely than those who feel more secure to say they will outlive their savings (39 percent vs. 27 percent) and are less likely to say their savings will be just about right (24 percent vs. 47 percent). Those with higher incomes are more likely to say that they will outlive their savings than those with lower incomes.

Similarly, 3 in 10 Americans age 50 and older anticipate that they will need to reduce their spending during retirement, 25 percent say they will be able to increase their spending, and 45 percent say they will be able to keep their spending about the same.

Americans age 65 and older are less likely than those age 50 to 64 to say they will need to reduce their spending (16 percent vs. 38 percent) and more likely to say they will be able to keep their spending about the same (62 percent vs. 33 percent).

Saving For Retirement Is Lowest Among Those Older Workers Already Struggling Under Other Financial Obligations.ꜛ

Among those Americans age 50 and older who are currently working (both not yet retired and working during their retirement), two-thirds say they are saving money for retirement to supplement Social Security income. This is down from 75 percent in 2013.

This decline is explained by a combination of two smaller changes. First, those who are working and not yet retired report slightly lower rates of saving for retirement in 2016 than in 2013 (70 percent vs. 78 percent). Second, the proportion of older workers who already consider themselves to be retired (relative to the entire older workforce) saw a small increase from 12 percent in 2013 to 16 percent in 2016. The already retired report lower savings rates than those who have not yet retired. This may be because they are using their earnings to cover current retirement expenses rather than draw from their existing retirement savings, but are not actively saving additional money.

As in 2013, feeling anxious about retirement is not related to saving money for retirement. Similar proportions of those who feel more anxious and those who feel more excited say that they are saving for retirement.

However, as in 2013, household income is closely tied to saving for retirement. Fewer than half of working Americans age 50 and older with household incomes of less than $50,000 a year are saving for retirement, compared with 69 percent of those with household incomes of $50,000 to $100,000 and 90 percent of those with household incomes of $100,000 or more. In addition, those who say they have enough income to pay their bills are twice as likely as those who say they are sometimes behind on payments to say they are saving for retirement (74 percent vs. 35 percent). Those who own their own home are more likely than those who rent to say they are saving for retirement (73 percent vs. 49 percent).

Fourteen percent of workers age 50 and older say they’ve had to borrow money from a retirement plan in the past year. Having to borrow from a retirement plan is not related to household income, but those who say they are sometimes behind on bill payments are twice as likely as those who say they are not to say they’ve had to borrow money from their retirement (23 percent vs. 11 percent).

A Majority Have Several Sources Of Retirement Income.ꜛ

The most widespread source of current or expected income for retirement among those age 50 and older is Social Security. Eighty-six percent say they have or will have Social Security income during retirement. A majority (56 percent) also say they have a retirement account like a 401(k), a 403(b), or an IRA. Nearly half say they have other savings (48 percent) or a pension (43 percent). Fewer have other investments (36 percent), physical assets such as real estate or a business to sell (22 percent), or disability payments (14 percent).

More than three-quarters (81 percent) say they have two or more of these sources of income for retirement, and a majority (60 percent) say they have three or more.

Among those who cite only one source of retirement income, that source is Social Security for nearly three-quarters (74 percent), disability payments for 11 percent, pensions for 6 percent, retirement accounts for 5 percent, and other savings, other investments, or planned sales of real estate or businesses for the remainder.

Findings from the University of Michigan’s Health and Retirement Study suggest that many plan to supplement these sources of income with another source—earned income. Roughly 6 in 10 adults of retirement age said they do not plan to leave the labor force when they leave their full-time career jobs.7 Data from the Social Security Administration back up these claims; earned income for those age 65 and older makes up twice as big a share of total income as compared to the mid-1980s.8

Household income levels are associated with the types of income people say they have for retirement. While little difference emerges between income levels in access to Social Security, those with higher incomes are more likely to have access to most of the other types of income asked about. They are also more likely to have a greater number of sources of retirement income. Eighty-one percent of those with $100,000 or more in income say they have three or more sources of retirement income, compared to 69 percent of those with $50,000-$100,000 in income and 47 percent of those with less than $50,000 in income.

Age is also associated with types of retirement income people say they have. Those age 65 and older (54 percent) are more likely than those age 50-54 (27 percent), age 55-59 (35 percent), and age 60-64 (42 percent) to say they have or will have a pension. They are also more likely to have other investments (43 percent vs. 32 percent, 29 percent and 29 percent, respectively).

Those who say they are already retired are more likely than those who are not to say they have a retirement account like a 401(k), 403(b), or IRA (62 percent vs. 51 percent), and disability payments (17 percent vs. 10 percent) as sources of retirement income.

Those who say they are mostly anxious about retirement are less likely than those who say they are mostly excited to say they have a pension (30 percent vs. 53 percent), other investments (24 percent vs. 46 percent), or other savings (40 percent vs. 56 percent). They are also less likely to say they have more than one source of retirement income (73 percent vs. 90 percent).

The Primary Source Of Retirement Income For Many Americans Is Social Security, And Many Plan To Claim It Early.ꜛ

Social Security is most often cited as the biggest source of retirement income. More than 4 in 10 adults age 50 and older report that Social Security is or will be their household’s biggest source of retirement income. This includes about 1 in 10 who indicate that Social Security will be their only source of retirement income.

Social Security is cited as the biggest source of retirement income at similar rates between those who are already retired and potentially drawing on Social Security and those who are still working and who are making estimates about the future.

Two in 10 say a pension is or will be their biggest source of retirement income. More than 1 in 10 say the same about retirement accounts. Disability payments, other investments, the sale of physical assets, or other savings are or will be the biggest source of household income for less than 1 in 10 adults age 50 and older.

Current income level is associated with what Americans say is or will be their biggest source of retirement income. More than half (54 percent) of those with incomes of less than $50,000 say Social Security is their main source of income during retirement, compared to 42 percent of those with incomes between $50,000 and $100,000 and 25 percent of those with incomes of $100,000 or more. On the other hand, those with incomes of $100,000 or more most often say that retirement accounts are their biggest source of income. Thirty percent say so, compared to just 15 percent of those with income between $50,000 and $100,000 and 9 percent of those with income below $50,000.

Age is also associated with the largest source of retirement income. Those age 60-64 (24 percent) and those age 65 and older (23 percent) are more likely than those age 50-54 (12 percent) to say pensions are their largest source of retirement income. On the other hand, those age 50-54 (25 percent) and those age 55-59 (21 percent) are more likely than those age 65 and older (10 percent) to say retirement accounts like a 401(k), 403(b), or IRA are their primary source of income. All of these age groups most often cite Social Security as the primary retirement income source, however.

According to the Social Security Administration, Americans can start receiving Social Security retirement benefits at age 62. But, depending on year of birth, the full retirement age ranges from age 65 to 67. When opting to receive benefits before reaching full retirement age, the value of the benefit is reduced by between 6 and 30 percent, depending on the elapsed time between receipt of benefits and full retirement age.9 According to this study, 43 percent say they plan to receive or already started receiving benefits before age 65, meaning many will receive a reduced benefit. Forty-four percent say between age 65 and 69. Nine percent say they will wait until after they turn 70. The average age at which those age 50 and older expect to start or have started collecting Social Security is 64.

Higher earners are more willing to wait to receive retirement benefits. Forty-six percent of those earning less than $100,000 a year say they will or have started accepting benefits before turning age 65, compared to 31 percent of those earning $100,000 or more.

Among adults age 50 and older, younger people are less likely to say they have or will start accepting Social Security before they turn age 65. Just 21 percent of those age 50-54 say they have or expect to start collecting Social Security benefits before age 65, compared to 36 percent of those age 55-59, 49 percent of those age 60-64, and 54 percent of those age 65 and older.

Many Aging Americans Lack Confidence And Support When It Comes To The Way Their Retirement Investments Are Managed.ꜛ

Among adults age 50 and older who have a retirement account like a 401(k), a 403(b), or an IRA, or any other investments, about equal numbers manage those assets on their own as do so with the help of a financial advisor. More than 4 in 10 say they manage their investments each of those ways. Fewer (19 percent) say a spouse, partner, or other family member provides investment help or guidance.

Older Americans who have retirement accounts or other investments do not feel overwhelmingly confident about the way these investments are being managed. Only about a third say they feel very or extremely confident that their retirement investments are being managed well. Another 32 percent say they are somewhat confident, and 36 percent are not very or not confident at all. There aren’t substantial differences in levels of confidence between those who manage their investments themselves and those with help from financial advisors or family members.

Those who say they are mostly anxious about retirement are more likely than those who say they are mostly excited to say they manage their investments on their own (52 percent vs. 34 percent). On the other hand, those who are mostly excited are more likely to say they have a financial advisor helping them manage their funds (51 percent vs. 37 percent).

To investigate the extent to which older Americans are planning for a time when they are less able to manage their own investments than they are now, we asked respondents about their future plans for this. A majority report that they plan to continue their current strategies.

The group that currently manages their own investments shows some flexibility here. Of the 41 percent who fall into this category, two-thirds plan to continue to continue to manage their investments without guidance. The remainder of these independent investors are roughly equally divided between planning to get help from a financial advisor as they age, planning to get help from a family member, and reporting that they are unsure.

Those who are mostly anxious about retirement are more likely than those who are mostly excited to say they will manage their own investments as they age (39 percent vs. 24 percent).

One In Three Retirees Feel They Had No Choice Except To Retire.ꜛ

A third of adults age 50 and older who are retired report that they did not retire by choice, a figure that is unchanged from 2013. Retirees’ beliefs about their retirement choice vary depending on age, income, length of time working for the same employer, and anxiety about retiring.

Adults age 65 years and older are much less likely than younger retirees to say they had no choice about retirement (25 percent vs. 63 percent among those age 50 to 54).

Retirees with lower income levels are more likely to report they had no choice in their retirement. For example, 40 percent of those with household incomes less than $50,000 a year say they had no choice, compared with 23 percent of those with household incomes of more than $50,000 a year.

Nearly half of retirees (43 percent) who worked with the same employer for less than 20 years say they had no choice, compared to only about a fourth of retirees (24 percent) who worked at the same employer for at least 20 years. Likewise, those age 50 and older who are anxious about their retirements are nearly three times more likely than those not anxious to report that they feel like they had no choice except to retire (60 percent vs. 18 percent).

The Majority Of Workers Say They Have Not Received Any Incentives To Either Retire Early Or Delay Retirement.ꜛ

A large majority of workers (85 percent) report their employer has not offered any incentives to either retire early or delay retirement. Only 7 percent of older workers say they have been offered incentives to retire early, and 5 percent say they have received offers to keep working and delay retirement.

Employment incentives are tied to how long Americans have worked for the same employer. Adults age 50 and older who have worked at the same employer for at least 20 years are more likely than those who have worked less time with the same employer to have received offers to retire early (10 percent vs. 5 percent) or delay retirement (10 percent vs. 2 percent).

About the Studyꜛ

Survey Methodology

This survey, funded by The Alfred P. Sloan Foundation, was conducted by The Associated Press-NORC Center for Public Affairs Research between the dates of March 8 and March 27, 2016. Staff from NORC at the University of Chicago, The Associated Press, and The Alfred P. Sloan Foundation collaborated on all aspects of the study.

Interviews for this survey were conducted with adults age 50 and older representing the 50 states and the District of Columbia. The majority of the data were collected using AmeriSpeak®, which is a probability-based panel designed to be representative of the U.S. household population. During the initial recruitment phase of the panel, randomly selected U.S. households were sampled with a known, non-zero probability of selection from the NORC National Sample Frame and then contacted by U.S. mail, email, telephone, and field interviewers (face-to-face). Panel members were randomly drawn from AmeriSpeak®, and 739 completed the survey via the web and 320 completed via telephone. The unweighted survey completion rate is 40.6 percent, the weighted panel recruitment rate is 36.9 percent, and the weighted household panel retention rate is 94.3 percent, for a cumulative response rate for the AmeriSpeak® sample of 14.1 percent.

In addition to the interviews completed using AmeriSpeak®, which were all conducted in English, 16 telephone interviews were conducted in Spanish with households that were re-contacted for this study after previously participating in a 2015 AP-NORC Center study and being identified as Spanish-speaking households. This previous study used a random digit dial sample of both landlines and cell phone numbers, as well as a list sample of Hispanic adults. The sample was provided by a third-party vendor, Marketing Systems Group, and this study screened for older adults. We only re-contacted households in which a respondent had completed the previous study in Spanish and indicated that they were at least 49 years of age in 2015. When re-contacting households for the present study, if we encountered households with more than one adult age 50 and older, we used a process that randomly selected which eligible adult would be interviewed. The sample included 9 respondents on landlines and 7 respondents on cell phones. Cell phone respondents were offered a monetary incentive for participating, as compensation for telephone usage charges. The response rate for this sample is 20.8 percent.

The total number of interviews completed for this study was 1,075, including 1,059 from the AmeriSpeak® panel, and 16 from the re-contacted sample. All telephone interviews were completed by professional interviewers who were carefully trained on the specific survey for this study. The combined response rate is 14.2 percent. The overall margin of sampling error is +/- 3.9 percentage points at the 95 percent confidence level, including the design effect. The margin of sampling error may be higher for subgroups.

Once the sample was selected and fielded, and all the study data were collected and made final, a weighting process was used to adjust for the study-specific sample design and any survey nonresponse. Study-specific base sampling weights were derived using a combination of the AmeriSpeak® final panel weight and the probability of selection associated with the sampled panel members. Since not all sampled panel members responded to the interview, an adjustment was needed to account for interview nonrespondents. This adjustment decreased potential nonresponse bias associated with sampled panel members who did not complete the interview for the study. The 16 completes from the re-contacted sample were added with appropriately assigned initial weights, which was approximated by the mean nonresponse adjusted weights of the Hispanic interview completes in the AmeriSpeak® panel. Furthermore, the interview nonresponse adjusted weights for all 1,075 eligible sampled completes were adjusted via a raking ratio method to population totals associated with the following socio-demographic characteristics: age, sex, education, race/ethnicity, and Census region. At this stage of weighting, any extreme weights were trimmed, and then weights were re-raked to the same population totals. The weighted data, which reflect the U.S. population of adults age 50 and older, were used for all analyses

All analyses were conducted using STATA (version 14), which allows for adjustment of standard errors for complex sample designs. All differences reported between subgroups of the U.S. population are at the 95 percent level of statistical significance, meaning that there is only a 5 percent (or less) probability that the observed differences could be attributed to chance variation in sampling. Additionally, bivariate differences between subgroups are only reported when they also remain robust in a multivariate model controlling for other demographic, political, and socioeconomic covariates. A comprehensive listing of all study questions, complete with tabulations of top-level results for each question, is available on The AP-NORC Center for Public Affairs Research website: www.apnorc.org.

Contributing Researchers

From NORC at the University of Chicago

Jennifer Benz

Becky Reimer

Emily Alvarez

Adam Allington

Trevor Tompson

Dan Malato

David Sterrett

Jennifer Titus

Brian Kirchhoff

Liz Kantor

Marjorie Connelly

Wei Zeng

Nada Ganesh

From The Associated Press

Emily Swanson

About the Associated Press-NORC Center for Public Affairs Research

The AP-NORC Center for Public Affairs Research taps into the power of social science research and the highest-quality journalism to bring key information to people across the nation and throughout the world.

- The Associated Press (AP) is the world’s essential news organization, bringing fast, unbiased news to all media platforms and formats.

- NORC at the University of Chicago is one of the oldest and most respected, independent research institutions in the world.

The two organizations have established The AP-NORC Center for Public Affairs Research to conduct, analyze, and distribute social science research in the public interest on newsworthy topics, and to use the power of journalism to tell the stories that research reveals.

The founding principles of The AP-NORC Center include a mandate to carefully preserve and protect the scientific integrity and objectivity of NORC and the journalistic independence of AP. All work conducted by the Center conforms to the highest levels of scientific integrity to prevent any real or perceived bias in the research. All of the work of the Center is subject to review by its advisory committee to help ensure it meets these standards. The Center will publicize the results of all studies and make all datasets and study documentation available to scholars and the public.

The complete topline data are available at www.apnorc.org.

Footnotesꜛ

1. U.S. Bureau of Labor Statistics. 2015. Labor force projections to 2024: the labor force is growing, but slowly. Monthly Labor Review. http://www.bls.gov/opub/mlr/2015/article/labor-force-projections-to-2024.htm.ꜛ

2. Administration on Aging. 2014. A Profile of Older Americans: 2014. http://www.aoa.acl.gov/Aging_Statistics/Profile/2014/docs/2014-Profile.pdf.ꜛ

3. Social Security Administration. 2016. Income of the Population 55 and Older, 2014. https://www.ssa.gov/policy/docs/statcomps/income_pop55/index.html.ꜛ

4. AP-NORC Center for Public Affairs Research. 2013. Working Longer: Older Americans’ Attitudes on Work and Retirement. http://apnorc.org/PDFs/Working%20Longer/AP-NORC%20Center_Working%20Longer%20Report-FINAL.pdf.ꜛ

5. AP-NORC Center for Public Affairs Research. 2016. Working Longer: The Disappearing Divide between Work Life and Retirement. http://apnorc.org/PDFs/Working%20Longer%202016/2016-05%20AP-NORC%20Working%20Longer_Report1.pdf.ꜛ

6. When asked about personal debt, respondents were asked to include car loans, credit card debt, school loans, home equity loans, medical debt, and other types of personal debt, but to exclude mortgages. Those who report having personal debt (55 percent) say the largest sources of that debt are: car loans (37 percent), credit cards (32 percent), home equity loans (11 percent), and medical bills (9 percent).ꜛ

7. Cahill, K.E., Giandrea, M.D., Quinn, J.F. 2006. Retirement patterns from career employment. Gerontologist, 4:514–523.ꜛ

8. Social Security Administration. April 2014. Income of the Aged Chartbook, 2012. https://www.ssa.gov/policy/docs/chartbooks/income_aged/2012/iac12.pdf.ꜛ

9. Social Security Administration. Retirement Planner: Full Retirement Age. https://www.ssa.gov/planners/retire/retirechart.html.ꜛ